A Comprehensive and Forward-Looking Guide

Introduction

This article delves into the fundamentals of the private wire model, covering its technical architecture, economic rationale, and future outlook in light of emerging trends like AI/HPC growth, sustainability commitments, and evolving energy regulations. We provide financial perspectives, and implementation guidance to help data center stakeholders evaluate the feasibility of private wire deployments.

Azura Consultancy specializes in guiding data center operators through the entire private wire lifecycle—from feasibility studies and regulatory compliance to advanced technical design and operational optimization.

2. The Growing Power Gap (2024–2025)

2.1 Real-World Capacity Shortfalls

- Ireland: EirGrid’s Generation Capacity Statement has repeatedly noted Dublin’s grid constraints. As of 2024, several data center expansions have been partially deferred or denied full power allocations due to surging AI loads.

- The Netherlands: Dutch grid operators like TenneT publicly warn about saturation in data center-heavy regions, impacting hyperscale developers planning multi-hundred-megawatt AI training clusters.

- UK (London Metro): National Grid’s Future Energy Scenarios highlight supply pressures in the M4 corridor. Some colocation providers report multi-year delays for power connections crucial to AI-focused tenants.

- USA (Northern Virginia): Dominion Energy’s Integrated Resource Plan anticipates potential supply gaps by 2025–2026 if HPC clusters come online faster than new substation builds. Hyperscale operators are exploring private wires and on-site power to mitigate risk.

- Singapore: Despite lifting a data center moratorium, power allocation policies remain strict. One major cloud provider in 2024 was granted only a fraction of the load it initially requested, specifically affecting its AI training capacity.

2.2 Forward AI‑Driven Demand Growth (2025–2030)

The table below summarizes headline projections from leading energy agencies and market analysts, providing the quantitative backdrop for why private wire architectures, on site generation, and large scale storage need to be baked into data center roadmaps now, not as a future add on.

| Metric | 2024 → 2030 Change | Source |

| Global electricity used by all data centres | rises from ≈ 460 TWh to ≈ 945 TWh—> more than Japan’s current consumption | (IEA) |

| Portion of that demand directly attributable to AI workloads | 4 × growth by 2030 | (IEA) |

| Total data centre power demand (capacity) | +50 % by 2027 and +165 % by 2030 versus 2023 | (Goldman Sachs) |

| AI share of installed DC power | 14 % (2023) → 27 % (2027) | (Goldman Sachs) |

Key Takeaway: Rapid expansions in AI and HPC workloads—where racks can exceed 30–50 kW/rack—continue to stress public grids. Private wires help fill the gap by providing direct, dedicated connections often backed by on-site or near-site generation.

3. Key Benefits of the Private Wire Model

- Energy Cost Control

- Avoiding Transmission Fees: Bypassing certain transmission and distribution charges can lower overall electricity costs.

- Long-Term Price Stability: Private wire PPAs (Power Purchase Agreements) can lock in fixed or indexed rates, providing more predictable energy budgets.

- Resilience and Reliability

- Dedicated Infrastructure: Minimizes shared grid vulnerabilities, reducing risk of regional brownouts.

- Custom Power Conditioning: Operators can integrate advanced power-quality systems (e.g., harmonic filters, voltage regulation) to protect sensitive AI/HPC loads.

- Sustainability and Decarbonization

- Direct Access to Renewables: Private wires make it easier to verify zero-carbon power sourcing, aligning with ESG and Scope 2 emissions targets.

- Traceable Green Power: Operators can pair generation with recognized RECs or Guarantees of Origin, strengthening sustainability claims.

- Control Over Generation and Storage

- On-Site or Near-Site Generation: Solar, wind, CHP, or fuel cells can feed directly into the data center.

- Export Opportunities: Surplus power can be sold to neighbors or the grid, offering potential revenue streams.

Key Takeaway: Private wires are not just about reliability—they also serve as strategic assets for cost management, ESG compliance, and energy innovation.

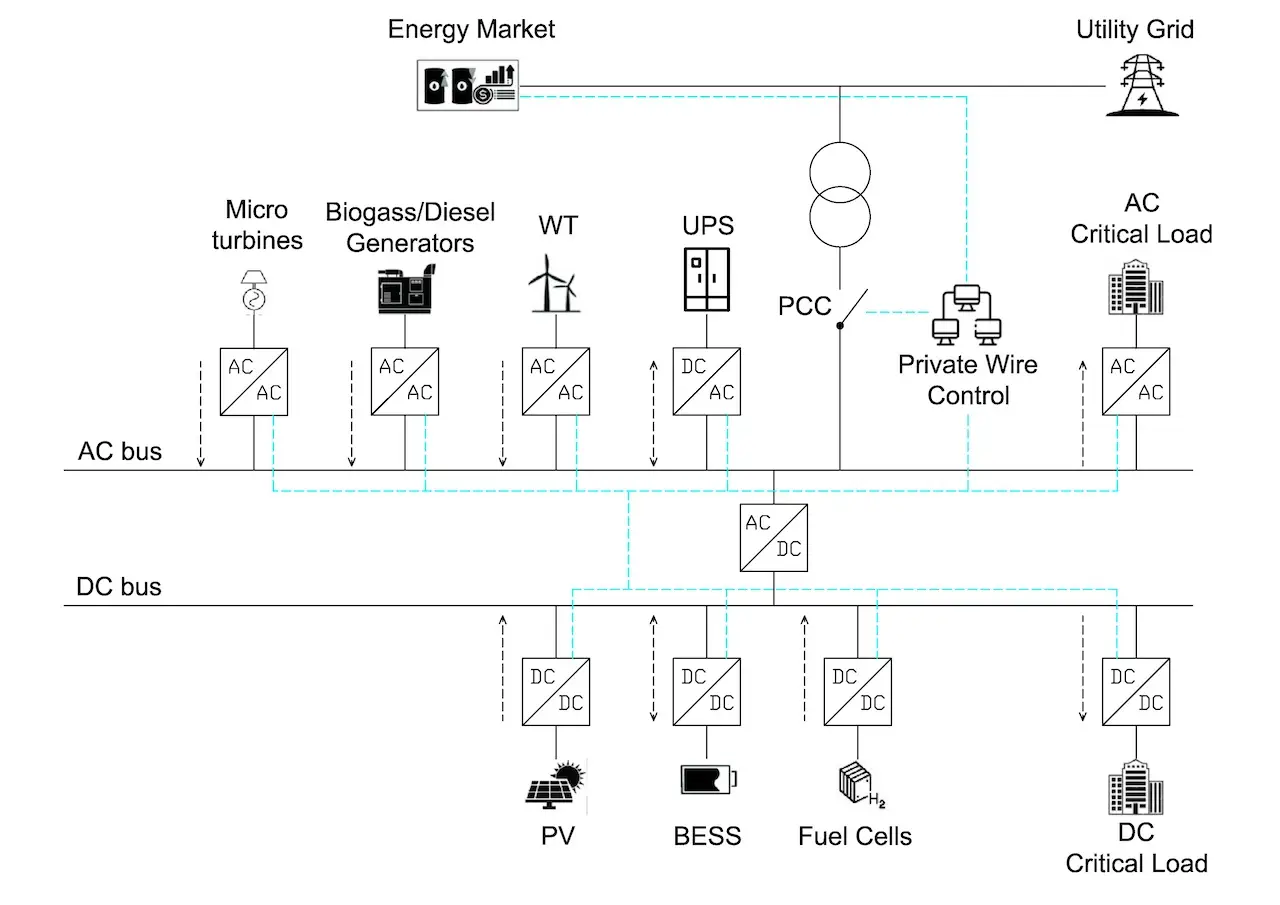

4. Technical Architecture and Design

4.1 Grid Connection vs. Islanded Operation

- Grid-Tied: Allows the data center to pull from the utility for supplemental power or sell surplus energy back. Requires switchgear and ATS (Automatic Transfer Switches) to manage transitions.

- Islanded Microgrids: Completely off-grid systems need robust SCADA controls, adequate generation, and storage capacity to handle peak AI loads and ensure continuous operation.

Operators typically prefer grid-tied solutions for redundancy. Fully islanded approaches can provide complete autonomy but demand significant capital and operational expertise.

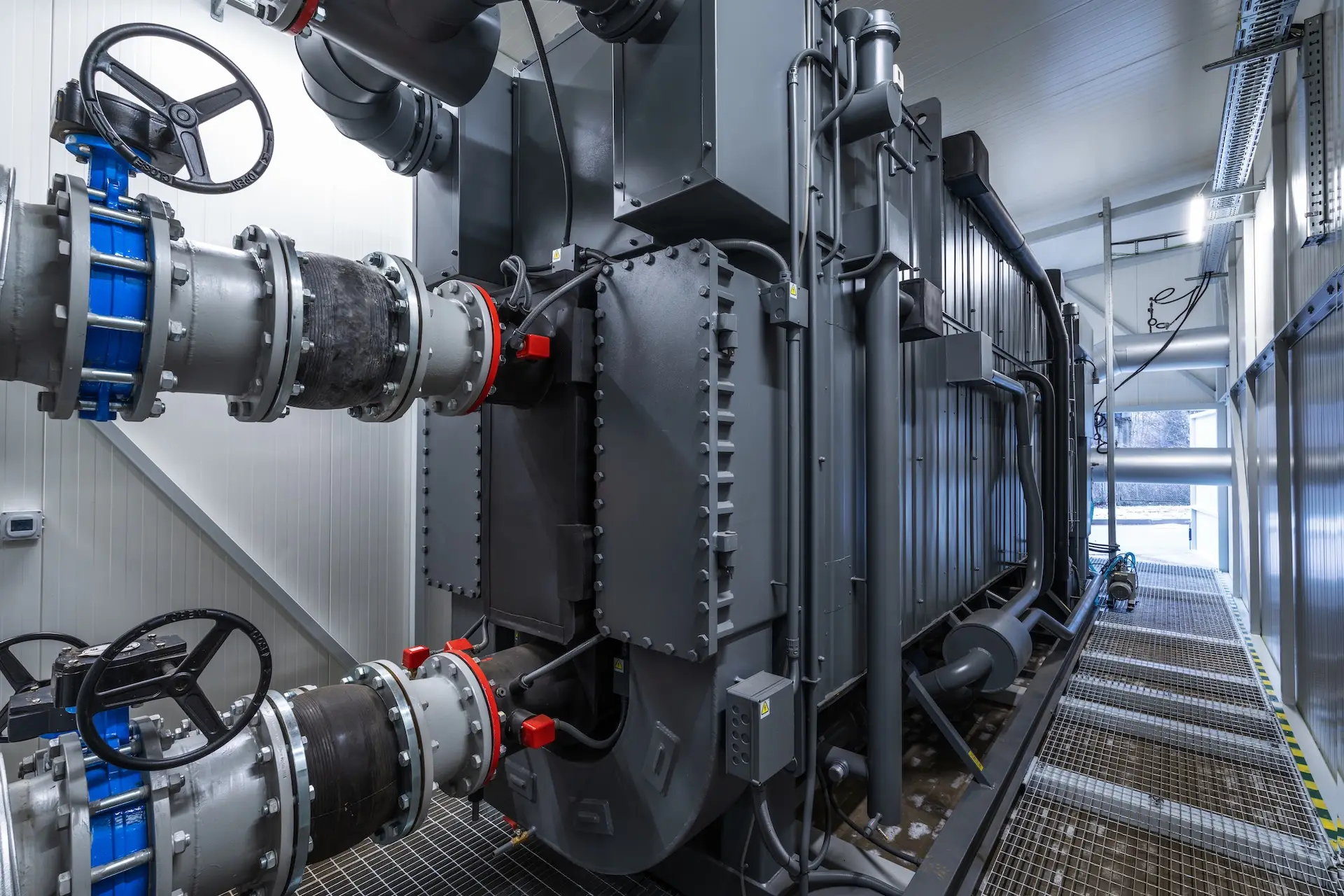

4.2 Power Infrastructure

- Substations & Switchgear: Data centers often deploy dedicated substations in N+1 or 2N configurations, ensuring no single point of failure.

- Cable Selection: Underground HV or MV lines sized for peak and future expansions, crucial in HPC contexts where loads can scale rapidly.

- Transformers: Multiple step-down transformers separating IT, mechanical, and critical loads. Ensures resilience and meets TIA-942 or Uptime Institute Tier requirements.

4.3 Metering, Monitoring, and Standards

- Advanced Metering Infrastructure (AMI): Real-time consumption tracking, power quality measurements, and potential net exports.

- SCADA Integration: Centralized control over private wires, local generation, and utility feeds.

- Regulatory References: Compliance with IEEE 1547 (US) or G99 (UK) for distributed generation interconnection.

Monitoring and compliance go hand-in-hand; robust SCADA and adherence to grid codes ensure safe, legal operation of private wire systems.

4.4 UPS, Generators, DRUPS, and Energy Storage

- UPS Systems

- Battery or Flywheel: Provide ride-through power for short-term bridging and correct power quality issues. Lithium-ion offers higher energy density; flywheels reduce battery footprint.

- DRUPS (Diesel Rotary Uninterruptible Power Supply)

- Mechanically integrated generator and UPS with a rotating mass for seamless power transfer.

- Efficient in certain scenarios; reduces reliance on large battery banks.

- Requires careful maintenance and typically uses diesel, raising emissions considerations.

- Backup Generators

- Diesel or Natural Gas for extended outages. Some data centers explore hydrogen or biogas to lower carbon footprint.

- Energy Storage

- Battery Systems (Large-Scale): Store intermittent renewable energy or shift loads to off-peak periods.

- Integration with Renewables: Smooths out solar or wind variability, enabling data centers to rely more heavily on green power.

A layered approach—UPS or DRUPS for short term, plus generators and battery storage for long term—is critical for Tier III/IV or HPC-grade resilience.

5. On-Site Power Generation

5.1 Current Technologies

- Natural Gas/Biogas Generators: Lower emissions than diesel, can run continuously or in peaking mode.

- Solar Photovoltaics (PV): Zero operational emissions; effective on rooftops or adjacent land.

- Wind Turbines: Viable where wind resources are strong; large installations require significant permitting.

- CHP (Combined Heat and Power): High overall efficiency by capturing and repurposing waste heat for cooling or district heating.

- Diesel Generators (Standby): Common but facing higher scrutiny due to emissions and local regulations.

5.2 Emerging and Future Technologies

- Fuel Cells (Hydrogen, Natural Gas): Can achieve near-zero carbon if powered by green hydrogen.

- Microturbines: Compact, lower-emission gas turbines that can scale for partial loads.

- Advanced Batteries: Emerging flow battery tech or next-gen lithium chemistries for extended discharge.

- Small Modular Reactors (SMRs): Longer-term potential for carbon-free baseload. Regulatory and public acceptance remain hurdles.

5.3 On‑Site Generation, Storage & Flexibility Potential

| Technology | Forward Projection | Why it Matters for Private Wire Strategy | Source |

| Grid scale & behind the meter battery storage | World cumulative installations hit ≈ 411 GW / 1.2 TWh by 2030 (15 fold growth vs 2021) | Batteries + private wire = frequency response, peak shave, black start | (Bloomberg NEF) |

| G7 target for electricity storage | 1,500 GW global storage by 2030 (6× 2022 level) | Strong policy tail wind for co located storage at DC campuses | (Financial Times) |

| Dominant cause of power related outages | On site electrical distribution—not utility failure—underscoring need for DRUPS, CHP & microgrids | Drives hybrid architectures (grid + genset + BESS + renewables) |

On-site generation choice depends on local resources, corporate ESG targets, and economic payback. Emerging tech like green hydrogen fuel cells may transform data center power strategies in the coming years.

6. Strengthening the Financial and ROI Perspective

6.1 Cost‑Benefit Analysis & Business Models

- Cost-Benefit Analysis

- Capital Expenditures (CapEx): Substation, cabling, on-site generation, DRUPS or UPS, etc.

- Operational Expenditures (OpEx): Fuel costs, maintenance, grid standby charges, potential staff or outsourcing.

- Revenue/Offset Streams: Savings on avoided transmission fees, surplus power sales, or demand response payments.

- Business Models

- Owned vs. Third-Party: Some data centers prefer a developer or energy partner to finance the generation assets, locking in power rates via a long-term PPA.

- Phased Implementation: Start with partial on-site generation; expand capacity as loads increase or ROI becomes clearer.

- ROI Drivers

- High Energy Density: AI/HPC racks can exceed 30–50 kW/rack, compressing ROI timelines if private wire saves enough on electricity costs.

- Sustainability Incentives: Government grants or carbon credits can offset capital investment in low-carbon generation.

6.2 Private‑Wire & Corporate‑PPA Economics

The figures below illustrate how fast the PPA market is scaling, why Europe has become a hotspot for private wire contracts, and how rising transmission grid investment needs are reinforcing the business case for dedicated supply pathways.

| Market Indicator | 2020 Baseline → 2030 Outlook | Source |

| Cumulative European corporate renewable PPAs (inc. near site private wires) | 14 GW contracted (2013 20); volumes rising 2 3 GW / yr and accelerating post 2024 | (Renewable Market Watch) |

| Global PPA contract value | US $ 28 bn (2023) → ≈ US $ 194 bn by 2030 (CAGR ≈ 32 %) | (Market.us Scoop) |

| Grid investment implied by DC growth | US $ 720 bn transmission spend needed world wide by 2030 | (Goldman Sachs) |

Conducting a holistic financial analysis—factoring in avoided utility costs, potential revenue, and sustainability-driven incentives—is vital for a successful private wire strategy.

7. Data Centers as Power Generators

7.1 Selling Surplus Power

- Net Metering or Feed-In Tariffs: Smaller-scale surplus may earn credits or feed-in payments.

- Private Wire to Nearby Loads: Excess capacity can be shared with local industrial or commercial neighbors, creating a microgrid ecosystem.

- Ancillary Services: Large battery systems or dispatchable generators can provide grid stability services like frequency regulation or peak shaving for additional revenue.

7.2 Considerations and Challenges

- Regulatory Approvals: Interconnection agreements, generation licensing, compliance with IEEE 1547, G99, etc.

- Metering Infrastructure: Revenue-grade meters and advanced SCADA for reliable measurement and billing.

- Economic Analysis: Surplus generation must be large enough and priced competitively to justify the infrastructure costs.

Data centers can evolve into energy hubs, offsetting operational costs or generating new revenue streams—provided they navigate the regulatory and technical complexities.

8. Sustainability Metrics and ESG Alignment

PUE and CUE

- PUE (Power Usage Effectiveness): May improve if the data center’s on-site generation is efficient or can provide waste heat recovery.

- CUE (Carbon Usage Effectiveness): Accessing direct renewable or low-carbon power reduces total greenhouse gas emissions per unit of IT load.

RECs, Guarantees of Origin, and Tracking

Data centers can purchase Renewable Energy Certificates (US) or Guarantees of Origin (EU) to validate their clean power usage. With a private wire, they can also directly tie generation to consumption for more transparent Environmental, Social, and Governance (ESG) reporting.

Water and Waste Heat Considerations

On-site generation (especially CHP or nuclear-based SMRs) can alter water usage and cooling strategies. Waste heat from on-site generation can be recycled into district heating or used for absorption chilling, further enhancing sustainability credentials

Strong sustainability metrics increasingly influence investor and customer perceptions. Private wire arrangements offer a clear path to demonstrable carbon reductions and resource optimization.

9. Implementation Guidance

- Phased Roadmap

- Feasibility Study: Evaluate local grid constraints, load forecasts, and technology options.

- Design & Permitting: Engage with utilities, comply with IEEE 1547/G99, and secure environmental permissions.

- Pilot & Rollout: Implement smaller-scale or partial generation first, then expand as demand grows.

- Operations & Maintenance: Establish robust maintenance schedules for DRUPS, on-site generators, and substation equipment.

- Risk Assessment

- Regulatory: Monitor changing policies (e.g., new emissions standards, stand-by charges).

- Technical: Ensure redundant systems are tested regularly (maintenance of DRUPS, battery, fuel supply).

- Financial: Account for market volatility in fuel or carbon credit pricing, and consider future expansions driven by AI/HPC.

- Partnerships

- Utilities: Collaborate on grid code compliance and potential capacity upgrades.

- Technology Vendors: DRUPS suppliers, fuel cell providers, or microturbine manufacturers can offer turnkey solutions.

- Energy Developers: PPA-based models can transfer CapEx burdens, locking in predictable rates.

A structured approach ensures that private wire projects align with business, technical, and sustainability objectives, reducing the risks of large-scale power infrastructure investment.

10. Legal Feasibility

When exploring a Data Center Private Wire setup, it’s essential to realize that legal feasibility varies significantly across regions. Each country—or even individual jurisdictions—may impose distinct requirements related to grid interconnection, licensing, environmental permits, and taxation for private wires. Operators must conduct thorough, location-specific due diligence, often consulting legal experts and local utilities to ensure full compliance and mitigate risks. Early engagement with regulatory bodies, combined with a detailed review of applicable grid codes and contractual frameworks, will help avoid costly setbacks and ensure a smooth path to implementing a successful private wire arrangement.

11. Future Outlook

- Accelerating AI and HPC Growth AI workloads, particularly large language model training, may increase data center loads by 3–4× over the next few years, amplifying the need for robust private wire architectures.

- Emerging Hydrogen Economy Green hydrogen production is anticipated to grow, potentially fueling data center fuel cells and drastically cutting emissions.

- Advanced Energy Management AI-driven digital twins can optimize private wire usage by forecasting loads and generation, minimizing costs and environmental impact.

- Regulatory and Market Structures Expect more incentives for on-site renewables and advanced storage, but also potential capacity or standby charges from utilities looking to recover grid costs.

- Data Centers as Energy Hubs Multi-tenant or colocation facilities may become local microgrid anchors, selling or exchanging surplus power with neighbors or back to the grid via peer-to-peer trading platforms.

Private wires will play a pivotal role in the evolving energy ecosystem, especially as data centers leverage new technologies and policy shifts to secure reliable, cost-effective, and sustainable power.

Conclusion

The private wire model provides a powerful solution for data centers confronted by escalating AI-driven workloads and uncertain grid capacity. By forging dedicated links to power sources and integrating on-site generation and energy storage, operators gain resilience, cost predictability, and clear sustainability advantages. Moreover, a data center with surplus capacity can participate in energy markets, extending its role from a simple power consumer to an active energy hub.

Implementing a successful private wire strategy requires thorough feasibility studies, robust design, and close coordination with utilities, regulators, and technology vendors. As AI and HPC loads continue to surge, and as green hydrogen, fuel cells, and advanced batteries gain traction, the private wire approach stands poised to become an essential pillar of next-generation data center infrastructure. By incorporating financial rigor, sustainability metrics, and forward-looking partnerships, data centers can secure a competitive edge while navigating the rapidly shifting energy landscape.

Ready to Take Control of Your Data Center Energy?

Contact Our Private Wire Experts Today to Unlock Cost Savings, Reliability, and Green Power!

Azura Consultancy: Expert Services for Data Center Private Wires

- Private Wire Strategy: Advising on technical ad commercial benefit analysis, long-term PPAs, and commercial frameworks to ensure predictable energy pricing.

- On-Site Power Generation: Designing and integrating renewables (solar, wind), fuel cells, CHP systems, and emerging technologies such as hydrogen-based solutions and SMRs.

- UPS & DRUPS Implementation: Optimizing backup architectures for high-density AI and HPC workloads, reducing risk of downtime.

- Grid Interconnection & Compliance: Navigating key standards (IEEE 1547, G99) and interconnection processes to safely synchronize with public or private grids.

- SCADA & Monitoring: Implementing advanced control systems for real-time power quality tracking, fault detection, and automated failover.

- Energy Storage & Sustainability: Evaluating battery systems, microgrids, and ancillary services for maximizing resiliency and ESG impact.

How Azura Consultancy Can Help

- Feasibility & ROI Analysis: We conduct in-depth cost-benefit reviews, load projections, and market assessments to determine the most advantageous private wire models.

- Design & Engineering: Our team architects robust, scalable energy infrastructure—covering substations, cable routing, DRUPS/UPS integration, and renewable/battery sizing.

- PPA Negotiation & Procurement: We assist in securing favorable power purchase agreements, enabling predictable energy pricing and risk mitigation.

- Regulatory & Compliance Support: We ensure adherence to local and international grid interconnection standards, environmental regulations, and permitting requirements.

- Project Management & Implementation: From initial vendor selection to final commissioning, we oversee each step to ensure on-time, on-budget delivery.

- Ongoing Optimization: Post-launch, we monitor performance, recommend improvements, and adapt energy strategies to evolving data center workloads—especially crucial for AI/HPC expansions.